Editor’s Note

This post reflects Backblaze B2 Cloud Storage pricing at the time it was published. We’ve since shared more recent price and product updates.

The arrival of Chia on the mainstream media radar brought with it some challenging and interesting questions here at Backblaze. As close followers of the hard drive market, we were at times intrigued, optimistic, cautious, concerned, and skeptical—often all at once. But, our curiosity won out. Chia is storage-heavy. We are a storage company. What does this mean for us? It was something we couldn’t ignore.

Backblaze has over an exabyte of data under management, and we typically maintain around three to four months worth of buffer space. We wondered—with this storage capacity and our expertise, should Backblaze farm Chia?

For customers who are ready to farm, we recently open-sourced software to store Chia plots using our cloud storage service, Backblaze B2. But deciding whether we should hop on a tractor and start plotting ourselves required a bunch of analysis, experimentation, and data crunching—in short, we went down the rabbit hole.

After proving out if this could work for our business, we wanted to share what we learned along the way in case it was useful to other teams pondering data-heavy cloud workloads like Chia.

Grab your gardening gloves, and we’ll get into the weeds.

Here’s a table of contents for those who want to go straight to the analysis:

- Should Backblaze Support and Farm Chia?

- Helping Backblaze Customers Farm

- Should Backblaze Farm?

- The Challenges of Plotting

- The Challenges of Farming

- Can We Make Money?

- Our Monetization and Cost Analysis for Farming Chia

- Should We Farm Chia? Our Decision and Why

- Afterword: The Future of Chia

If you’re new to the conversation, here’s a description of what Chia is and how it works. Feel free to skip if you’re already in the know.

Chia is a cryptocurrency that employs a proof of space and time algorithm that is billed as a greener alternative to coins like Bitcoin or Ethereum—it’s storage-intensive rather than energy-intensive. There are two ways to play the Chia market: speculating on the coin or farming plots (the equivalent of “mining” other cryptocurrencies). Plots can be thought of as big bingo cards with a bunch of numbers. The Chia Network issues match challenges, and if your plot has the right numbers, you win a block reward worth two Chia coins.

Folks interested in participating need to be able to generate plots (plotting) and store them somewhere so that the Chia blockchain software can issue match challenges (farming). The requirements are pretty simple:

- A computer running Windows, MacOS, or Linux with an SSD to generate plots.

- HDD storage to store the plots.

- Chia blockchain software.

But, as we’ll get into, things can get complicated, fast.

Should Backblaze Support and Farm Chia?

The way we saw it, we had two options for the role we wanted to play in the Chia market, if at all. We could:

- Enable customers to farm Chia.

- Farm it ourselves using our B2 Native API or by writing directly to our hard drives.

Helping Backblaze Customers Farm

We didn’t see it as an either/or, and so, early on we decided to find a way to enable customers to farm Chia on Backblaze B2. There were a few reasons for this choice:

- We’re always looking for ways to make it easy for customers to use our storage platform.

- With Chia’s rapid rise in popularity causing a worldwide shortage of hard drives, we figured people would be anxious for ways to farm plots without forking out for hard drives that had jumped up $300 or more in price.

- Once you create a plot, you want to hang onto it, so customer retention looked promising.

- The Backblaze Storage Cloud provides the keys for successful Chia farming: There is no provisioning necessary, so Chia farmers can upload new plots at speed and scale.

However, Chia software was not designed to allow farming with public cloud object storage. On a local storage solution, Chia’s quality check reads, which must be completed in under 28 seconds, can be cached by the kernel. Without caching optimizations and a way to read plots concurrently, cloud storage doesn’t serve the Chia use case. Our early tests confirmed this, taking longer than the required 28 seconds.

So our team built an experimental workaround to parallelize operations and speed up the process, which you can read more about here. Short story: The experiment has worked, so far, but we’re still in a learning mode about this use case.

Should Backblaze Farm?

Enabling customers to farm Chia was a fun experiment for our Engineering team, but deciding whether we could or should farm Chia ourselves took some more thinking. First, the pros:

- We maintain a certain amount of buffer space. It’s an important asset to ensure we can scale with our customer’s needs. Rather than farming in a speculative fashion and hoping to recoup an investment in farming infrastructure, we could utilize the infrastructure we already have, which we could reclaim at any point. Doing so would allow us to farm Chia in a non-speculative fashion more efficiently than most Chia farmers.

- Farming Chia could make our buffer space profitable when it would otherwise be sitting on the shelves or drawing down power in the live buffer.

- When we started investigating Chia, the Chia Calculator said we could potentially make $250,000 per week before expenses.

These were enticing enough prospects to generate significant debate on our leadership team. But, we might be putting the cart before the horse here… While we have loads of HDDs sitting around where we could farm Chia plots, we first needed a way to create Chia plots (plotting).

The Challenges of Plotting

Generating plots at speed and scale introduces a number of issues:

- It requires a lot of system resources: You need a multi-core processor with fast cores so you can make multiple plots at once (parallel plotting) and a high amount of RAM.

- It quickly wears out expensive SSDs: Plotting requires at least 256.6GB of temporary storage, and that temporary storage does a lot of work—about 1.8TB of reading and writing. An HDD can only read/write at 120 MB/s. So, people typically use SSDs to plot, and particularly NVMe drives which are much faster than HDD, often over 3000 MB/s. While SSD drives are fast, they wear out like tires. They’re not defective, reading and writing at the pace it takes to plot Chia just burns them out. Some reports estimate four weeks of useful farming life, and it’s not advisable to use consumer SSDs for that reason.

At Backblaze, we have plenty of HDDs, but not many free SSDs. Thus, we’d need to either buy (and wear out) a bunch of SSDs, or use a cloud compute provider to generate the plots for us.

The first option would take time and resources to build enough plotters in each of our data centers across the country and in Europe, and we could potentially be left with excess SSDs at the end. The second would still render a bunch of SSDs useless, albeit not ours, and it would be costly.

Still, we wondered if it would be worth it given the Chia Calculator’s forecasts.

The Challenges of Farming

Once we figured out a way to plot Chia, we then had a few options to consider for farming Chia: Should we farm by writing directly to the extra hard drives we had on the shelves, or by using our B2 Native API to fill the live storage buffer?

Writing directly to our hard drives posed some challenges. The buffer drives on the shelf eventually do need to go into production. If we chose this path, we would need a plan to continually migrate the data off of drives destined for production to new drives as they come in. And we’d need to dedicate staff resources to manage the process of farming on the drives without affecting core operations. Reallocating staff resources to a farming venture could be seen as a distraction, but a worthy one if it panned out. We once thought of developing B2 Cloud Storage as a distraction when it was first suggested, and today, it’s integral to our business. That’s why it’s always worth considering these sorts of questions.

Farming Chia using the B2 Native API to write to the live storage buffer would pull fewer staff resources away from other projects, at least once we figured out our plotting infrastructure. But we would need a way to overwrite the plots with customer data if demand suddenly spiked.

And the Final Question: Can We Make Money?

Even with the operational challenges above and the time it would take to work through solutions, we still wondered if it would all be worth it. We like finding novel solutions to interesting problems, so understanding the financial side of the equation was the last step of our evaluation. Would Chia farming make financial sense for Backblaze?

Farming Seemed Like It Could Be Lucrative…

The prospect of over $1M/month in income certainly caught our attention, especially because we thought we could feasibly do it “for free,” or at least without the kind of upfront investment in HDDs a typical Chia farmer would have to lay out to farm at scale. But then we came to our analysis of monetization.

Our Monetization and Cost Analysis for Farming Chia

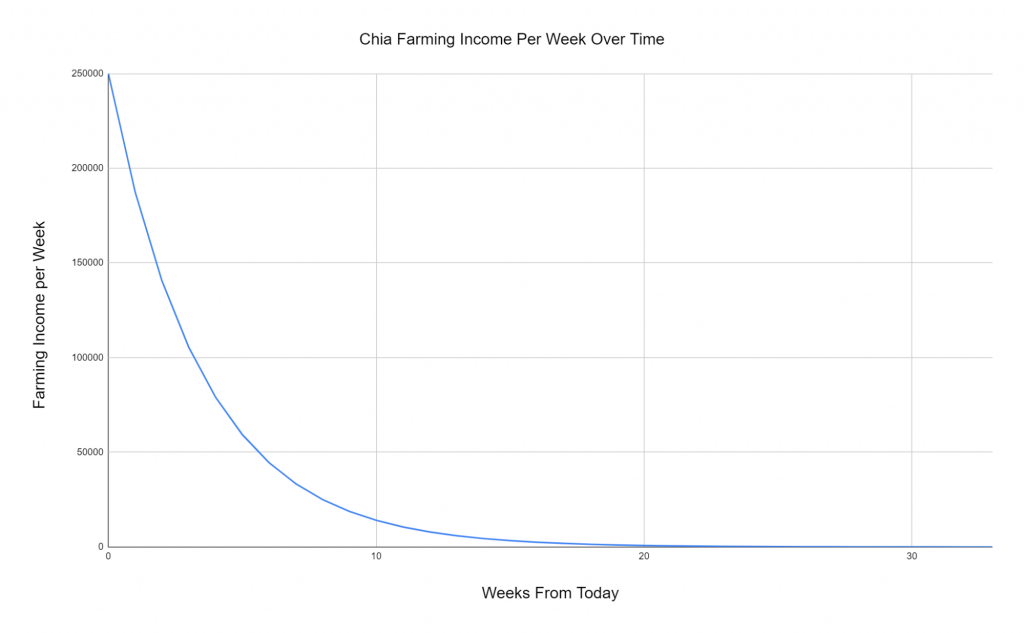

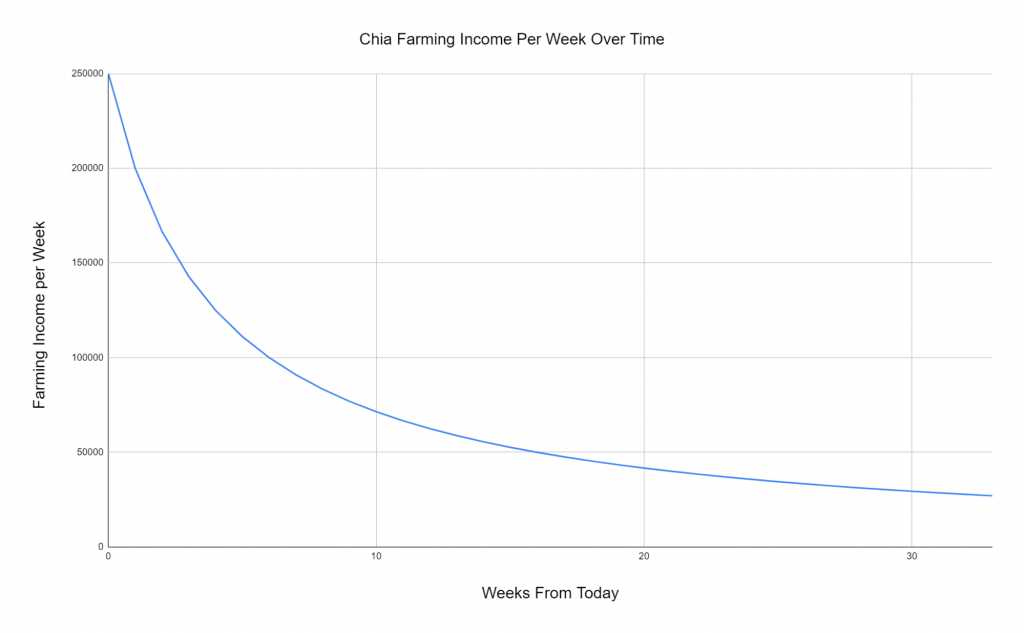

Colin Weld, one of our software engineers, had done some analysis on his own when Chia first gained attention. He built on that analysis to calculate the amount of farming income we could make per week over time with a fixed amount of storage.

Our assumptions for the purposes of this analysis:

- 150PB of the buffer would be utilized.

- The value of the coin is constant. (In reality, the value of the coin opened at $584.60 on June 8, 2021, when we ran the experiments. In the time since, it has dipped as low as $205.73 before increasing to $278.59 at the time of publishing.)

- When we ran the calculations, the total Network space appeared to increase at a rate of 33% every week.

- We estimated income in week one was 75% of the week before, with the percentage decreasing exponentially over time.

- When we ran the calculations, the income per week on 150PB of storage was $250,000.

- We assumed zero costs for the purposes of this experiment.

Assuming Exponential Growth of the Chia Netspace

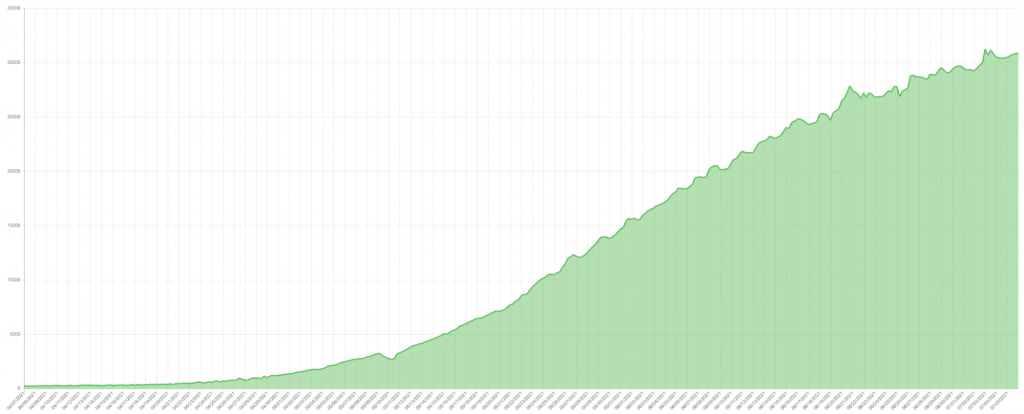

If the Chia Netspace continued to grow at an exponential rate, our farming income per week would be effectively zero after 16 weeks. In the time since we ran the experiment, the total Chia Netspace has continued to grow, but at a slightly slower rate.

Total Chia Netspace April 7, 2021–July 5, 2021

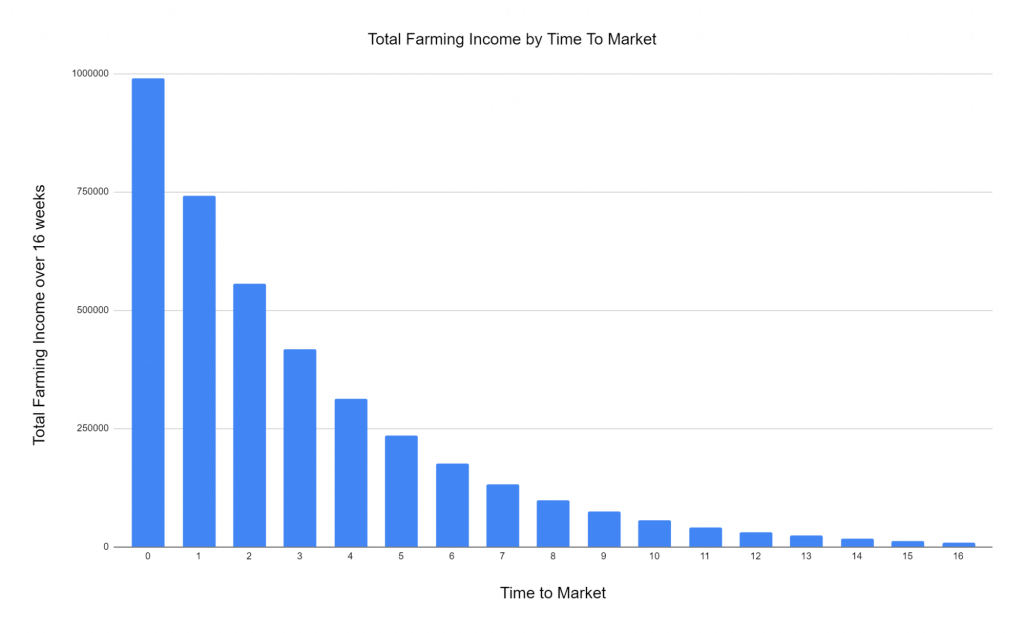

For kicks, we also ran the analysis assuming a constant rate of growth. In this model, we assume a constant growth rate of five exabytes each week.

Assuming Constant Growth of the Chia Netspace

Even assuming constant growth, our farming income per week would continue to decrease, and this doesn’t account for our costs.

And Farming Wasn’t Going to Be Free

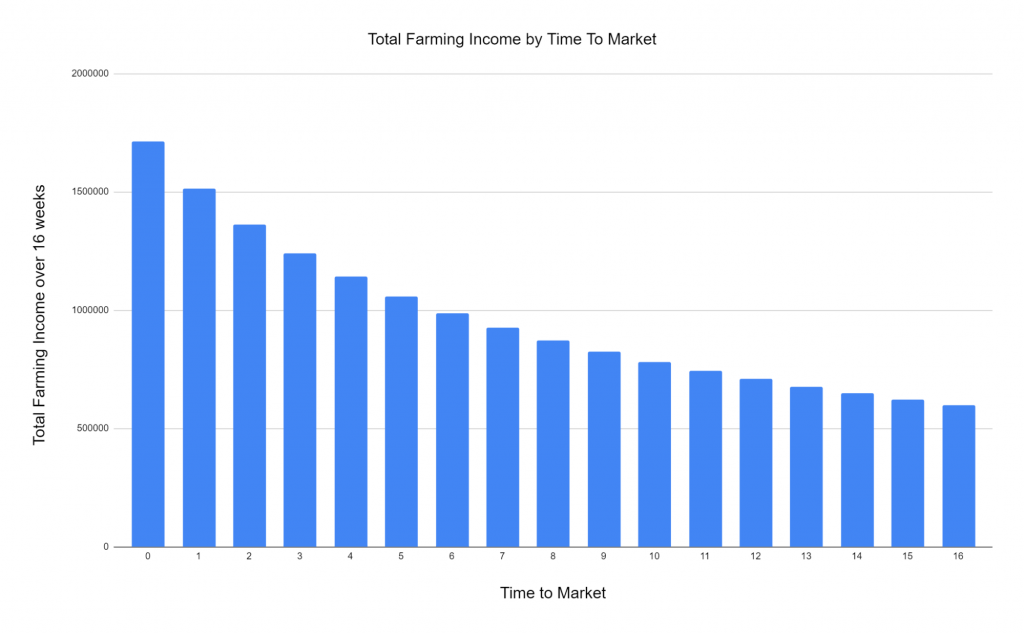

To quickly understand what costs would look like, we used our standard pricing of $5/TB/month as our effective “cost” as it factors in our cost of goods sold, overhead, and the additional work this effort would require. At $5/TB/month, 150PB costs $175,000 per week. Assuming exponential growth, our costs would exceed total expected income if we started farming any later than seven weeks out from when we ran the analysis. Assuming constant growth, costs would exceed total expected income around week 28.

A Word on the Network Price

In our experiments, we assumed the value of the coin was constant, which is obviously false. There’s certainly a point where the value of the coin would make farming theoretically profitable, but the volatility of the market means we can’t predict if it will stay profitable. The value of the coin and thus the profitability of farming could change arbitrarily from day to day. It’s also unlikely that the coin would increase in value without the triggering simultaneous growth of the Netspace, thus negating any gains from the increase in value given our fixed farming capacity. From the beginning, we never intended to farm Chia in a speculative fashion, so we never considered a possible value of the coin that would make it worth it to farm temporarily and ignore the volatility.

Chia Network Price May 3, 2021–July 5, 2021

Should We Farm Chia? Our Decision and Why

Ultimately, we decided not to farm Chia. The cons outweighed the pros for us:

- We wouldn’t reap the rewards the calculators told us we could because the calculators give a point-in-time prediction. The amount per week you could stand to make is true—for that week. Today, the Chia Calculator predicts we would only make around $400 per month.

- While it would have been a fun experiment, figuring out how to plot Chia at speed and scale would have taken time we didn’t have if we expected it to be profitable.

- We assume the total Chia Netspace will continue to grow even if it grows at a slower rate. As the Netspace grows, your chances of winning go down unless you can keep growing your plots as fast as the whole Network is growing. Even if we dedicated our whole business to it, there would come a point where we would not keep up because we have a fixed amount of storage to dedicate to farming while maintaining a non-speculative position.

- It would usurp resources we didn’t want to devote. We’d have to dedicate part of our operation to manage the process of farming on the drives without affecting core operations.

- If we farmed it using our B2 Native API to write to our live buffer, we’d risk losing plots if we had to overwrite them when demand spiked.

Finally, cryptocurrency is a polarizing topic. The lively debate among our team members sparked the idea for this post. Our team holds strong opinions about the direction we take, and rightfully so—we value open communication as well as unconventional opinions both for and against proposed directions. Some brought strong arguments against participation in the cryptocurrency market even as they indulged in the analysis along the way. In the end, along with the operational challenges and disappointing financials, farming Chia was not the right choice for us.

The experiment wasn’t all for nothing though. We still think it would be great to find a way to make our storage buffer more profitable, and this exercise sparked some other interesting ideas for doing that in a more sustainable way that we’re excited to explore.

Our Chia Conclusion… For Now

For now, our buffer will remain a buffer—our metaphorical fields devoid of rows upon rows of Chia. Farming Chia didn’t make sense for us, but we love watching people experiment with storage. We’re excited to see what folks do with our experimental solution for farming Chia on Backblaze B2 and to watch what happens in the market. If the value of Chia coin spikes and farming plots on B2 Cloud Storage allows farmers to scale their plots infinitely, all the better. In the meantime, we’ll put our farming tools away and focus on making that storage astonishingly easy.

Afterword: The Future of Chia

This exercise begs the question: Should anyone farm Chia? That’s a decision everyone has to make for themselves. But, as our analysis suggests, unless you can continue to grow your plots, there will come a time when it’s no longer profitable. That may not matter to some—if you believe in Chia and think it will increase in value and be profitable again at some point in the future, holding on to your plots may be worth it.

How Pooling Could Help

On the plus side, pooling technology could be a boon for smaller farmers. The Chia Network recently announced pooling functionality for all farmers. Much like the office lottery, farmers group their plots for a share of challenge rewards. For folks who missed the first wave of plotting, this approach offers a way to greatly increase their chances of winning a challenge, even if it does mean a diminished share of the winnings.

The Wastefulness Questions

Profitability aside, cryptocurrency coins are a massive drain on the environment. Coins that use proof of space and time like Chia are billed as a greener alternative. There’s an argument to be made that Chia could drive greater utilization of otherwise unused HDD space, but it still leads to an increase of e-waste in the form of burned out SSD drives.

Coins based on different algorithms might hold some promise for being more environmentally friendly—for example, proof of stake algorithms. You don’t need proof of space (lots or storage) or proof of work (lots of power), you just need a portion of money (a stake) in the system. Ethereum has been working on a transition to proof of stake, but it will take more time and testing—something to keep an eye on if you’re interested in the crypto market. As in everything crypto, we’re in the early days and the only thing we can count on is change, unpredictability, and the monetary value of anything Elon Musk Tweets about.