In our blog post on Tuesday, Cryptocurrency Security Challenges, we wrote about the two primary challenges faced by anyone interested in safely and profitably participating in the cryptocurrency economy: 1) make sure you’re dealing with reputable and ethical companies and services, and 2) keep your cryptocurrency holdings safe and secure.

In this post, we’re going to focus on how to make sure you don’t lose any of your cryptocurrency holdings through accident, theft, or carelessness. You do that by backing up the keys needed to sell or trade your currencies.

$34 Billion in Lost Value

Of the 16.4 million Bitcoin said to be in circulation in the middle of 2017, close to 3.8 million, may have been lost because their owners no longer are able to claim their holdings. Based on today’s valuation, that could total as much as $34 billion dollars in lost value. And that’s just Bitcoin. There are now over 1,500 different cryptocurrencies, and we don’t know how many of those have been misplaced or lost.

Now that some cryptocurrencies have reached (at least for now) staggering heights in value, it’s likely that owners will be more careful in keeping track of the keys needed to use their cryptocurrencies. For the ones already lost, however, the owners have been separated from their currencies just as surely as if they had thrown Benjamin Franklins and Grover Clevelands over the railing of a ship.

The Basics of Securing Your Cryptocurrencies

In our previous post, we reviewed how cryptocurrency keys work, and the common ways owners can keep track of them. A cryptocurrency owner needs two keys to use their currencies: a public key that can be shared with others is used to receive currency, and a private key that must be kept secure is used to spend or trade currency.

Many wallets and applications allow the user to require extra security to access them, such as a password, or iris, face, or thumb print scan. If one of these options is available in your wallets, take advantage of it. Beyond that, it’s essential to back up your wallet, either using the backup feature built into some applications and wallets, or manually backing up the data used by the wallet. When backing up, it’s a good idea to back up the entire wallet, as some wallets require additional private data to operate that might not be apparent.

No matter which backup method you use, it is important to back up often and have multiple backups, preferable in different locations. As with any valuable data, a 3-2-1 backup strategy is good to follow, which ensures that you’ll have a good backup copy if anything goes wrong with one or more copies of your data.

One more caveat, don’t reuse passwords. This applies to all of your accounts, but is especially important for something as critical as your finances. Don’t ever use the same password for more than one account. If security is breached on one of your accounts, someone could connect your name or ID with other accounts, and will attempt to use the password there, as well. Consider using a password manager such as LastPass or 1Password, which make creating and using complex and unique passwords easy no matter where you’re trying to sign in.

Approaches to Backing Up Your Cryptocurrency Keys

There are numerous ways to be sure your keys are backed up. Let’s take them one by one.

1. Automatic Backups Using a Backup Program.

If you’re using a wallet program on your computer, for example, Bitcoin Core, it will store your keys, along with other information, in a file. For Bitcoin Core, that file is wallet.dat. Other currencies will use the same or a different file name and some give you the option to select a name for the wallet file.

To back up the wallet.dat or other wallet file, you might need to tell your backup program to explicitly back up that file. Users of Backblaze Backup don’t have to worry about configuring this, since by default, Backblaze Backup will back up all data files. You should determine where your particular cryptocurrency, wallet, or application stores your keys, and make sure the necessary file(s) are backed up if your backup program requires you to select which files are included in the backup.

Backblaze B2 is an option for those interested in low-cost and high security cloud storage of their cryptocurrency keys. Backblaze B2 supports 2-factor verification for account access, works with a number of apps that support automatic backups with error recovery and versioning, and offers an API and command-line interface (CLI), as well. The first 10GB of storage is free, which could be all one needs to store encrypted cryptocurrency keys.

2. Backing up by Exporting Keys to a File.

Apps and wallets will let you export your keys from your app or wallet to a file. Once exported, your keys can be stored on a local drive, USB thumb drive, direct attached storage system, network attached storage system, or in the cloud with any cloud storage or sync service you wish. Encrypting the file is strongly encouraged—more on that later. If you use 1Password or LastPass, or another secure notes program, you also could store your keys there.

3. Backing up by Saving a Mnemonic Recovery Seed.

A mnemonic phrase, mnemonic recovery phrase, or mnemonic seed is a list of words that stores all the information needed to recover a cryptocurrency wallet. Many wallets will have the option to generate a mnemonic backup phrase, which can be written down on paper. If the user’s computer no longer works or their hard drive becomes corrupted, they can download the same wallet software again and use the mnemonic recovery phrase to restore their keys.

The phrase can be used by anyone to recover the keys, so it must be kept safe. Mnemonic phrases are an excellent way of backing up and storing cryptocurrency and so they are used by almost all wallets.

A mnemonic recovery seed is represented by a group of easy to remember words. For example:

eye female unfair moon genius pipe nuclear width dizzy forum cricket know expire purse laptop scale identify cube pause crucial day cigar noise receive

The above words represent the following seed:

0a5b25e1dab6039d22cd57469744499863962daba9d2844243fec 9c0313c1448d1a0b2cd9e230a78775556f9b514a8be45802c2808e fd449a20234e9262dfa69

These words have certain properties:

- The first four letters are enough to unambiguously identify the word.

- Similar words are avoided (such as: build and built).

Bitcoin and most other cryptocurrencies such as Litecoin, Ethereum, and others use mnemonic seeds that are 12 to 24 words long. Other currencies might use different length seeds.

4. Physical Backups—Paper, Metal.

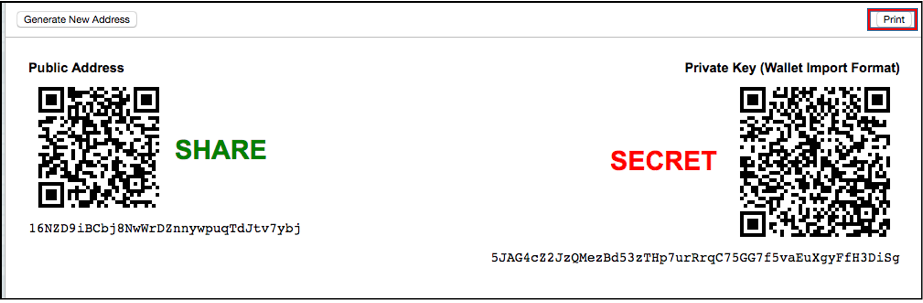

Some cryptocurrency holders believe that their backup, or even all their cryptocurrency account information, should be stored entirely separately from the internet to avoid any risk of their information being compromised through hacks, exploits, or leaks. This type of storage is called “cold storage.” One method of cold storage involves printing out the keys to a piece of paper and then erasing any record of the keys from all computer systems. The keys can be entered into a program from the paper when needed, or scanned from a QR code printed on the paper.

Printed public and private keys.

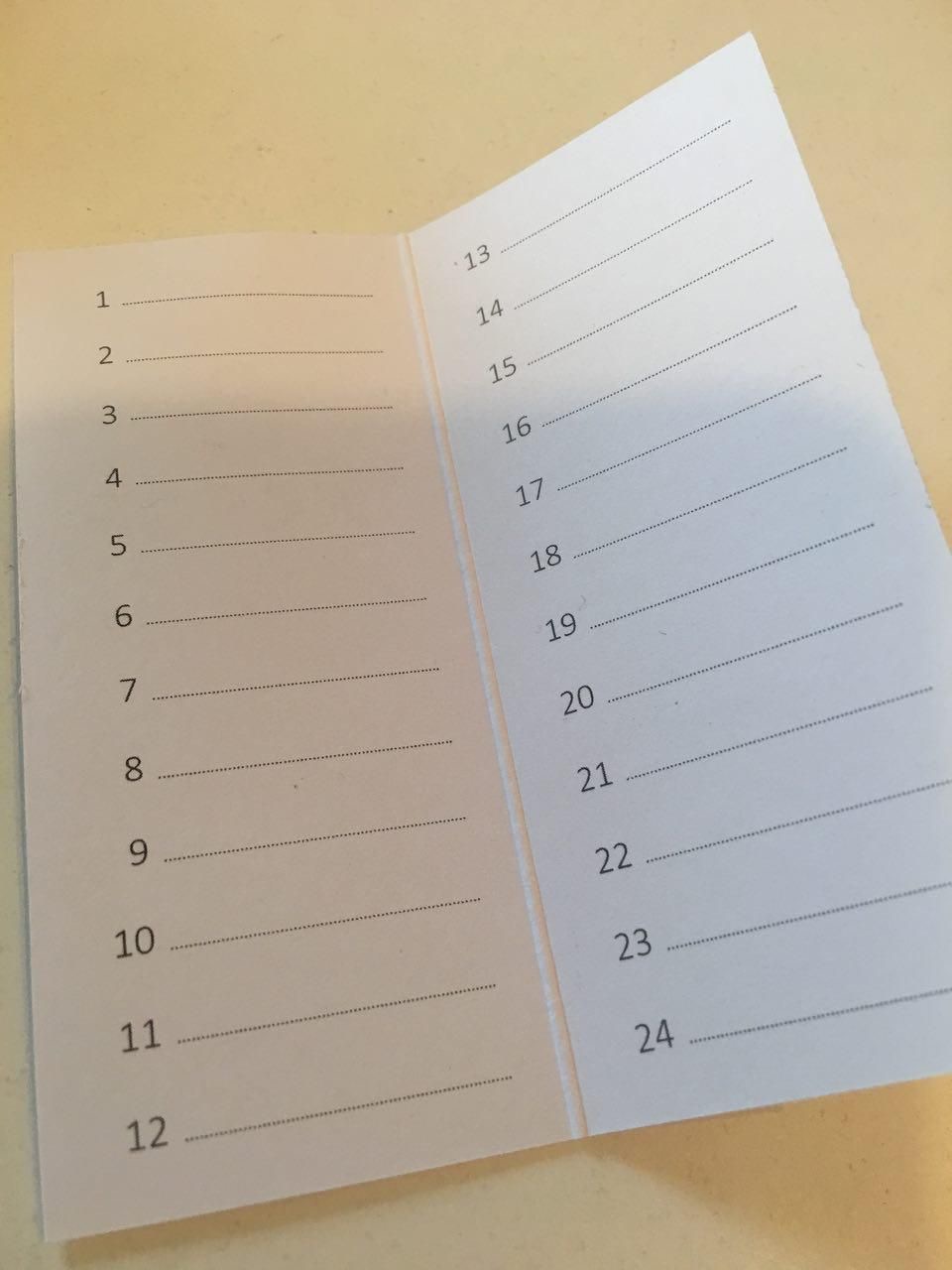

Some who go to extremes suggest separating the mnemonic needed to access an account into individual pieces of paper and storing those pieces in different locations in the home or office, or even different geographical locations. Some say this is a bad idea since it could be possible to reconstruct the mnemonic from one or more pieces. How diligent you wish to be in protecting these codes is up to you.

Mnemonic recovery phrase booklet.

There’s another option that could make you the envy of your friends. That’s the CryptoSteel wallet, which is a stainless steel metal case that comes with more than 250 stainless steel letter tiles engraved on each side. Codes and passwords are assembled manually from the supplied part-randomized set of tiles. Users are able to store up to 96 characters worth of confidential information. Cryptosteel claims to be fireproof, waterproof, and shock-proof.

Cryptosteel cold wallet.

Of course, if you leave your crypto wallet in the pocket of a pair of ripped jeans that gets thrown out by the housekeeper, as happened to the character Russ Hanneman on the TV show “Silicon Valley” in last Sunday’s episode, then you’re out of luck. That fictional billionaire investor lost a USB drive with $300 million in cryptocoins. Let’s hope that doesn’t happen to you.

Russ looking for his lost USB crypto wallet on the TV show “Silicon Valley”

Encryption & Security

Whether you store your keys on your computer, an external disk, a USB drive, a direct attached storage system, a network attached storage system, or in the cloud, you want to make sure that no one else can use those keys. The best way to handle that is to encrypt the backup.

With Backblaze Computer Backup for Windows and Mac, your backups are encrypted in transmission to the cloud and on the backup server. Users have the option to add an additional level of security by adding a Personal Encryption Key (PEK), which secures their private key. Your cryptocurrency backup files are secure in the cloud. Using our web or mobile interface, previous versions of files can be accessed, as well.

Our object storage cloud offering, Backblaze B2 Cloud Storage, can be used with a variety of applications for Windows, Macintosh, and Linux. With Backblaze B2, cryptocurrency users can choose whichever method of encryption they wish to use on their local computers and then upload their encrypted currency keys to the cloud. Depending on the client used, versioning and lifecycle rules can be applied to the stored files.

Other backup programs and systems provide some or all of these capabilities, as well. If you are backing up to a local drive, it is a good idea to encrypt the local backup, which is an option in some backup programs.

Address Security

Some experts recommend using a different address for each cryptocurrency transaction. Since the address is not the same as your wallet, this means that you are not creating a new wallet, but simply using a new identifier for people sending you cryptocurrency. Creating a new address is usually as easy as clicking a button in the wallet.

One of the chief advantages of using a different address for each transaction is anonymity. Each time you use an address, you put more information into the public ledger (blockchain) about where the currency came from or where it went. That means that over time, using the same address repeatedly could mean that someone could map your relationships, transactions, and incoming funds. The more you use that address, the more information someone can learn about you. For more on this topic, refer to address reuse.

Note that a downside of using a paper wallet with a single key pair (type-0 non-deterministic wallet) is that it has the vulnerabilities listed above. Each transaction using that paper wallet will add to the public record of transactions associated with that address. Newer wallets, e.g. “deterministic” or those using mnemonic code words support multiple addresses and are now recommended.

There are other approaches to keeping your cryptocurrency transaction secure. Here are a couple of them.

Multi-signature

Multi-signature refers to requiring more than one key to authorize a transaction, much like requiring more than one key to open a safe. It is generally used to divide up responsibility for possession of cryptocurrency. Standard transactions could be called “single-signature transactions” because transfers require only one signature—from the owner of the private key associated with the currency address (public key). Some wallets and apps can be configured to require more than one signature, which means that a group of people, businesses, or other entities all must agree to trade in the cryptocurrencies.

Deep Cold Storage

Deep cold storage ensures the entire transaction process happens in an offline environment. There are typically three elements to deep cold storage.

First, the wallet and private key are generated offline, and the signing of transactions happens on a system not connected to the internet in any manner. This ensures it’s never exposed to a potentially compromised system or connection.

Second, details are secured with encryption to ensure that even if the wallet file ends up in the wrong hands, the information is protected.

Third, storage of the encrypted wallet file or paper wallet is generally at a location or facility that has restricted access, such as a safety deposit box at a bank.

Deep cold storage is used to safeguard a large individual cryptocurrency portfolio held for the long term, or for trustees holding cryptocurrency on behalf of others, and is possibly the safest method to ensure a crypto investment remains secure.

Keep Your Software Up to Date

You should always make sure that you are using the latest version of your app or wallet software, which includes important stability and security fixes. Installing updates for all other software on your computer or mobile device is also important to keep your wallet environment safer.

One Last Thing: Think About Your Testament

Your cryptocurrency funds can be lost forever if you don’t have a backup plan for your peers and family. If the location of your wallets or your passwords is not known by anyone when you are gone, there is no hope that your funds will ever be recovered. Taking a bit of time on these matters can make a huge difference.

To the Moon*

Are you comfortable with how you’re managing and backing up your cryptocurrency wallets and keys? Do you have a suggestion for keeping your cryptocurrencies safe that we missed above? Please let us know in the comments.

*To the Moon: Crypto slang for a currency that reaches an optimistic price projection.